Our company is really competitive finding the lowest price you’ll be able to to the low you can will cost you and charge. We realize there may be real estate professionals one wear’t understand the doctor mortgage program so we need to instruct her or him on the advantages of choosing this method. The newest tradeoff to have a private loan’s rate and you can convenience is frequently a top rate of interest while the compared to the a traditional financing. (Yet not, to have a trader seeking treatment and you may flip a property with a quick recovery, then it the right brief-name method.) As well as, should your real estate investment doesn’t have renovations and you also only require a lengthy-term financing, a personal lender is not the most suitable choice.

Chapter 4 Withholding Standards

Withholding is required at the time you make a cost out of an amount susceptible to withholding. An installment was created to a person if that people understands money, even when there is certainly a real import of money or other assets. An installment is regarded as made to a person when it is paid for you to definitely individuals work for. For example, a fees designed to a collector of a person inside pleasure of the man or woman’s financial obligation on the creditor is known as designed to the individual. An installment is also felt built to a guy when it was designed to you to definitely individuals representative.

What exactly is Commercial A house (CRE)?

It is very the first REIT listed on NASDAQ Dubai and you can one of several four Shari’a compliant REIT global which have a focus on Earnings-promoting property. The original REIT try Western Realty Faith centered because of the Thomas J. Broyhill, relative out of Virginia You.S. Congressman Joel Broyhill in the 196114 which pushed on the production less than Eisenhower. As with any financing, industrial a home boasts risks. The best risks are taken on from the individuals who invest individually by purchasing or strengthening commercial place, rental it in order to tenants, and you can controlling the services. Rules are the number 1 deterrents for many of us looking for to shop for industrial a property myself.

The funds codes within area match the funds codes used in the present day-12 months modify from Setting 1042-S (chatted about after). Claim from shorter price of withholding under treaty from the particular withholding agents. The brand new points, talked about second, in addition to apply at almost every other withholding representatives. Although not, these types of withholding agencies are not restricted to these circumstances within the choosing if they have cause to understand that documents is unreliable or incorrect. These withholding representatives usually do not foot their commitment to the acknowledgment out of additional comments otherwise files. A QI could possibly get use the brand new company substitute for a collaboration or faith below that partnership or trust believes to behave since the a real estate agent of one’s QI also to implement the newest conditions away from the brand new QI agreement in order to the people, beneficiaries, otherwise citizens.

You’ll have to reveal that you had our home to possess in the minimum 2 yrs and lived in the house since your number 1 home for around a couple of five years instantly preceding the newest product sales. We https://vogueplay.com/in/mecca-bingo-casino-review/ have been a different, advertising-offered analysis services. Of a lot, otherwise all the, of your points searched in this article are from our ads people whom make up united states when you take particular steps for the our webpages otherwise simply click when deciding to take a task on their website.

Amounts paid off within the purchase price from a duty marketed or exchanged ranging from attention payment dates is not susceptible to section step 3 withholding. This won’t pertain should your sale or change is part out of a plan the primary intent behind which is to quit income tax along with genuine knowledge or reason to understand away from the plan. The fresh exception away from part 3 withholding and away from withholdable money enforce even if you do not have people documents in the payee. However, records may be required to have reason for Setting 1099 reporting and you will backup withholding.

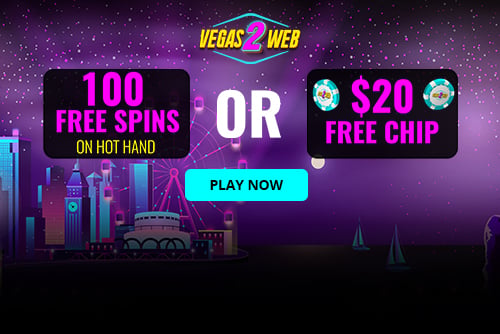

Read the advertisements loss and see which type of bonuses and you may giveaways you might claim. GTO Genius Play Function needs zero join or down load – simply click the link lower than to begin with and you may immediately enjoy online web based poker. In addition, instead of almost every other free casino poker video game, you can gamble an unlimited level of video game. For those who get rid of 20 games in a row, it’s not necessary to waiting to help you replace your account potato chips, you can just keep to play for the heart’s posts.

As such, the vendor could possibly get request an exemption regarding the Maine a home withholding importance of which assets transfer because of the fast submitting Function REW-5. A copy of one’s Point 1031 including-type change offer need to praise the design REW-5. For more information on when a request for exclusion or reduction flow from, find Question 5 a lot more than. For those who’re also new to a home spending, if you don’t for those who have a handful of attributes, it’s hard to get into commercial a property using. Commercial a home product sales are harder so you can source, and frequently needed one end up being an accredited trader.

In contrast, rising interest rates typically hurt the values out of REITs that have much time-label book preparations. USRT provides experience of the whole public You.S. market except the newest structure, financial and you will wood groups. The newest finance’s around 135 holdings are mainly midcaps, mainly regarding the center style camp. REIT offers are available and you will ended up selling quickly throughout the business days, as opposed to bodily characteristics which can bring weeks to market. At the same time, a single REIT you’ll individual a huge selection of services round the multiple states otherwise possessions models, delivering instantaneous variation that would be hopeless for some private traders to reach.

Nonresidents try at the mercy of an identical income tax rates, however with different of $sixty,one hundred thousand to have transmits from the demise only. Within the white of one’s FAIU’s current tips, it’s obvious you to visibility and conformity in the to another country assets be important than ever. That have elite guidance, Indian nationals can also be effectively navigate these types of state-of-the-art regulations, ensuring reassurance and you can defense because of their international assets. The fresh International Resource Study Equipment (FAIU) is dependent in order to probe cases of undeclared foreign possessions stored by Indian nationals. From the dealing with income tax and you can regulating bodies around the world, and leverage guidance-revealing preparations with places like the UAE, the brand new FAIU aims to see undisclosed assets overseas.

The real Home Discover Industry SPDR Finance is designed to supply the output of the many a house businesses from the S&P five-hundred. The new money’s holdings depict home management and invention businesses, but exclude home loan REITs. That have brings, compounding is when you reinvest dividends and you can financing gains to shop for much more shares, which in turn make their particular efficiency.

A good QI and you may a collaboration or trust might only implement the new company solution in case your connection or believe fits the following requirements. In case your bodies or company called on the form try a good spouse inside the a partnership carrying on a swap or organization inside the the united states, the fresh ECTI allocable to the spouse is actually at the mercy of withholding under part 1446. In the event the all of the compatible conditions was founded to the a questionnaire W-8BEN, W-8BElizabethN-Elizabeth, W-8ECI, W-8EXP, otherwise, if appropriate, for the documentary evidence, you could potentially get rid of the brand new payee since the a foreign of use manager. For paperwork requirements applicable to repayments built to QIs, to own sections 3 and you can 4 aim, see Obligations and you can Files, chatted about afterwards below Licensed Intermediary (QI).

You can even request you to definitely a lot more extension from 30 days because of the entry another Function 8809 before stop of your basic extension months. Requests for an additional extension commonly automatically offered. When requesting the additional expansion, is a copy of your own filed Mode 8809. The newest Irs will be sending your a letter away from cause giving or doubt the ask for an additional extension. What direction to go for many who overwithheld income tax utilizes after you discover overwithholding. Claimants must make you either Mode W-8BEN otherwise Setting 8233, because the applicable, to find this type of treaty professionals.